Business

Top Payroll Services for Small Businesses in 2024

Small Businesses need payroll services to thrive. Payroll services in 2024 offer more than just number crunching. Tech innovation transforms how businesses handle payroll, making processes smoother and faster. The right payroll service can save time and reduce stress. Small business owners can focus on growth instead of paperwork. This blog helps small businesses find the perfect payroll service for their needs.

Small businesses have a lot to gain from payroll services in 2024. Tech innovation has made these services more efficient and user-friendly. Let’s dive into some top options available.

Overview of Payroll Services in 2024

OnPay Payroll Service

OnPay stands out for its comprehensive payroll and HR solution tailored for small businesses. The service offers a straightforward pricing model at $40 plus $6 per employee per month. This fee includes all essential features like unlimited payroll runs, automated tax filing, and direct deposit. OnPay also provides excellent integration options with third-party accounting and timekeeping applications. The platform ensures compliance with its error-free tax filing guarantee.

OnPay is ideal for small businesses and nonprofit organizations seeking a full-service payroll solution. The service caters to both W-2 and 1099 workers, making it versatile for different business needs. Startups looking for a user-friendly interface will find OnPay particularly appealing.

Pros and Cons

Pros:

- Unlimited payroll runs

- Automated tax filing with an error-free guarantee

- Comprehensive HR resources

Cons:

- Pricing may be higher for businesses with many employees

Gusto

Gusto offers a robust payroll solution that includes benefits administration and HR tools. The platform integrates seamlessly with existing health insurance plans, simplifying the transition for businesses. Gusto’s payroll service is particularly beneficial for companies with remote teams and contractors.

Gusto is best suited for small to mid-sized entities that require a comprehensive payroll and HR management system. Businesses that frequently hire freelancers or contractors will find Gusto’s features advantageous.

Pros and Cons

Pros:

- Comprehensive benefits administration

- Integration with existing health insurance plans

- Suitable for remote teams

Cons:

- May not be the most cost-effective option for very small businesses

Justworks

Justworks excels as a professional employer organization (PEO) service. It offers self-service payroll processing along with HR management and benefits administration. Justworks acts as a co-employer, handling compliance and other HR functions for businesses.

Justworks is perfect for teams that want to outsource payroll and HR responsibilities. Companies looking for comprehensive support in managing employees will benefit from Justworks’ PEO services.

Pros and Cons

Pros:

- Comprehensive HR and payroll services

- PEO model offers extensive support

- Simplifies compliance management

Cons:

- PEO services may not be necessary for all businesses

Image Source: innovatureinc

Methodology

Selecting the best payroll services in 2024 requires a thoughtful approach. The methodology involves evaluating key criteria to ensure small businesses get the most value.

Criteria for Selection

Reliability stands as a cornerstone in choosing payroll services. Businesses need a service that consistently delivers accurate results. Errors in payroll can cause significant issues, so a reliable service is essential. Providers with a strong track record of reliability gain preference.

Cost-effectiveness matters greatly to small businesses. Finding a service that offers excellent features without breaking the bank is crucial. The evaluation considers both upfront costs and any hidden fees. Services that provide transparent pricing structures often rank higher.

User-friendliness determines how easily business owners can navigate the platform. A complicated interface can lead to mistakes and frustration. Payroll services with intuitive designs and easy-to-use dashboards receive higher marks. Small businesses benefit from platforms that simplify processes.

Research Process

The research process involves gathering data from various reputable sources. Reviews from users on platforms like G2 and Capterra provide valuable insights. Expert analyses and industry reports also contribute to understanding the strengths and weaknesses of each service.

Evaluation techniques focus on comparing key differences among providers. Factors like cost, features, ease of use, and customer service play a significant role. A comprehensive comparison helps identify which services stand out in each category. This structured approach ensures small businesses find the best fit for their needs.

Factors to Consider When Choosing a Payroll Servic

Choosing the right payroll service can feel like a daunting task. But understanding the key factors can make the decision much easier. Let’s explore what you should consider when selecting payroll services in 2024.

Business Size and Needs

The number of employees plays a crucial role in selecting a payroll service. A small business with fewer employees might prefer a simpler solution. Larger teams may require more robust features. The right service should handle your current workforce and scale as your business grows.

Budget constraints often dictate the choice of payroll services. Small businesses need cost-effective solutions without sacrificing essential features. Affordable options like Patriot offer great value. Businesses should compare pricing models and choose a service that fits their budget.

Image Source: innovation-sa

Features and Integrations

Essential features make payroll services valuable. Look for services that offer automated tax filing, direct deposit, and compliance support. These features save time and reduce errors. A service with comprehensive features ensures smooth payroll operations.

Integration with other tools enhances the functionality of payroll services. Businesses benefit from services that sync with accounting software and HR systems. Seamless integration streamlines processes and improves efficiency. Choose a service that works well with your existing systems.

Customer Support and Service

Availability of customer support is vital for resolving issues quickly. Businesses need access to support when problems arise. Services offering 24/7 support provide peace of mind. Ensure the provider offers reliable and accessible support.

Quality of support can make or break your experience with a payroll service. Good support helps navigate challenges and optimize service use. Look for providers with positive reviews on platforms like G2 and Capterra. High-quality support enhances overall satisfaction.

Selecting the right payroll service involves careful consideration of these factors. Each business has unique needs, so take the time to evaluate options. A well-chosen service will streamline processes and support business growth.

What is a Payroll Service & Benefit Small Businesses?

Payroll services handle the complex process of paying employees. These services calculate wages, deduct taxes, and ensure compliance with regulations. Many small business owners find payroll tasks time-consuming. A survey revealed that one-third of small businesses spend over six hours each month managing payroll. Payroll services simplify this process by automating calculations and filings. This allows business owners to focus on growth instead of paperwork.

Payroll services increase efficiency and accuracy in handling employee payments. Tech innovation has made these services more user-friendly. Automated systems reduce errors and save time. Small businesses benefit from accurate tax filings and timely payments. A survey found that 63% of small business owners underestimate the time needed for payroll processing. Payroll services streamline these tasks, allowing businesses to operate smoothly.

What Are the Costs Involved?

Costs for payroll services vary based on features and business size. Some services charge a flat monthly fee, while others have per-employee pricing. Business owners should compare different pricing models to find the best fit. Transparent pricing structures help avoid hidden fees. Many small businesses seek cost-effective solutions without sacrificing essential features. Understanding the costs involved helps businesses make informed decisions.

Choosing the right payroll service is crucial for small business success. The right service streamlines operations and ensures compliance. Business owners should assess specific needs before making a decision. Evaluating factors like cost, features, and customer support helps in selecting the best fit. The future of payroll services looks promising with technological advancements. Automation and AI reduce errors and increase efficiency. Cloud-based systems offer scalability and real-time access. Self-service portals enhance transparency. Mobile-friendly platforms provide convenience. Businesses that adopt these trends will manage payroll efficiently and effectively.

Business

Top 5 Affordable Travel Insurance Plans

Travel insurance plays a crucial role in ensuring a smooth journey. Many travelers, about 58%, purchase travel insurance for vacations. This decision stems from the peace of mind that insurance provides. Imagine facing unexpected events like trip cancellations or medical emergencies without a safety net. Travel insurance steps in to cover these unforeseen expenses. Travelers often find that reimbursements can be six times the policy’s cost. Business trips also benefit from this financial protection. The assurance of having travel insurance allows travelers to focus on enjoying their adventures.

Maybe you’ve never used travel insurance before. Or maybe you’ve just purchased travel insurance, and now you’re scrolling through your policy documents, wondering what it all means. We’re here to help!

This guide explains the basics: how travel insurance works, how to choose a plan, and how to get the most out of your coverage.

What is travel insurance?

Travel insurance is a plan you purchase that protects you from certain financial risks and losses that can occur while traveling. These losses can be minor, like a delayed suitcase, or significant, like a last-minute trip cancellation or a medical emergency overseas.

In addition to financial protection, the other huge benefit of travel insurance is access to assistance services, wherever you are in the world. Our elite team of travel and medical experts can arrange medical treatment in an emergency, monitor your care, serve as interpreters, help you replace lost passports and so much more. Sometimes, they even save travelers’ lives.

A few things you should know about travel insurance:

- Benefits vary by plan. It’s important to choose a plan that fits your needs, your budget and your travel plans. Here are definitions of all available travel insurance benefits.

- Travel insurance can’t cover every possible situation. Allianz Travel Insurance is named perils travel insurance, which means it covers only the specific situations, events, and losses included in your plan documents, and only under the conditions we describe.

- Travel insurance is designed to cover unforeseeable events not things you could easily see coming, or things within your control. If, for example, you wait to buy insurance for your beach trip until after a named hurricane is hustling toward your destination, your losses wouldn’t be covered.

How does travel insurance work?

In most scenarios, travel insurance reimburses you for your covered financial losses after you file a claim and the claim is approved. Filing a claim means submitting proof of your loss to Allianz Global Assistance, so that we can verify what happened and reimburse you for your covered losses. You can file a claim online, or do it on your phone with the Allyz® TravelSmart app.

How does this work in real life? Let’s say you purchase the OneTrip Prime Plan, which includes trip cancellation benefits, to protect your upcoming cruise to Cozumel. Two days before departure, you experience a high fever and chest pain. Your doctor diagnoses bacterial pneumonia and advises you to cancel the trip. When you notify the cruise line, they tell you it’s too late to receive a refund.

Without travel insurance, you’d lose the money you spent on your vacation. Fortunately, a serious, disabling illness can be considered a covered reason for trip cancellation, which means you can be reimbursed for your prepaid, nonrefundable trip costs. Once you’re feeling better, you gather the required documents—such as your airfare and cruise line receipts and information about any refunds you did or did not receive—and you file a claim. You can even choose to receive your reimbursement by direct deposit, to your debit card, or via check.

Sometimes, this process works a little differently. Travel insurance may pay your expenses upfront if you require emergency medical treatment or emergency transportation while traveling overseas. Or, with the OneTrip Premier and OneTrip Prime plans, you may be eligible to receive a fixed payment of $100 per day for a covered travel delay or $100 for a covered baggage delay. No receipts for purchases are required; all you need is proof of your covered delay.

Many travelers are wondering: Can COVID-19 be considered a covered reason for trip cancellation? And can travel insurance help if you become seriously ill with COVID-19 while traveling? Most of our travel insurance plans now include epidemic-related covered reasons (benefits vary by plan and are not available in all jurisdictions). The Epidemic Coverage Endorsement adds covered reasons to select benefits for certain losses related to COVID-19 and any future epidemic. To see if your plan includes this endorsement and what it covers, please look for “Epidemic Coverage Endorsement” on your Declarations of Coverage or Letter of Confirmation. Terms, conditions and exclusions apply. Benefits may not cover the full cost of your loss. All benefits are subject to maximum limits of liability, which may in some cases be subject to sublimits and daily maximums.

Overview of Top 5 Affordable Travel Insurance Plans

Exploring the world is exciting, but unexpected events can turn a dream vacation into a nightmare. That’s where travel insurance comes in handy. Let’s dive into the top five affordable travel insurance plans that offer great value for your money.

Plan 1: Allianz Travel Insurance OneTrip Prime Plan

Allianz Travel Insurance offers the OneTrip Prime Plan, which is perfect for those seeking comprehensive coverage. This plan includes trip cancellation protection and emergency medical assistance. It also covers travel delays and lost baggage.

The OneTrip Prime Plan provides peace of mind with its extensive benefits. Families will appreciate that children 17 and under are covered for free when traveling with a parent or grandparent. The plan also offers 24/7 access to a dedicated team of travel and medical experts.

Pricing for the OneTrip Prime Plan varies based on trip details and coverage needs. However, Allianz is known for offering affordable options, starting at around $27.

Plan 2: Travel Guard Essential Plan

Travel Guard provides the Essential Plan, which is ideal for budget-conscious travelers. This plan includes basic coverages such as trip cancellation, trip interruption, and travel delay.

The Essential Plan offers essential protection for both business and domestic travel. Travelers benefit from coverage for baggage loss or delay and medical expenses during the trip.

The Travel Guard Essential Plan is one of the most budget-friendly options available. It provides necessary coverage without breaking the bank.

Image Source: keeoko

Plan 3: Nationwide Travel Insurance

Nationwide Travel Insurance offers plans that cater to various travel needs. Key features include trip cancellation, emergency medical coverage, and baggage protection.

Nationwide’s plans provide reliable protection for travelers. The plans ensure coverage for unforeseen events, allowing travelers to enjoy their trips without worry.

Nationwide is recognized for its competitive pricing. The cost of coverage typically aligns with industry standards, making it an attractive option for many travelers.

Plan 4: Trawick International

Trawick International offers the Explorer Plan, which suits both leisure and business travelers. This plan provides comprehensive coverage for domestic and international trips. Key features include trip cancellation and interruption, $50,000 coverage for emergency medical expenses, and baggage protection. The plan also includes Worldwide 24/7 Emergency Assistance Services.

The Explorer Plan ensures travelers have access to essential benefits at a competitive rate. Travelers can rely on emergency medical assistance and support in case of trip interruptions. The plan covers baggage loss or delay, providing peace of mind during travel. The 24/7 emergency assistance service stands ready to help in any situation.

Pricing for the Explorer Plan remains budget-friendly, making it an attractive option for cost-conscious travelers. The comprehensive coverage offered by Trawick International ensures value for money without compromising on essential benefits.

Plan 5: Travelex Insurance Services

Travelex Insurance Services provides plans that cater to various travel needs. The plans offer trip cancellation, trip interruption, and emergency medical coverage. Travelers benefit from baggage protection and travel delay coverage. Travelex ensures travelers have access to necessary protections during their journeys.

Travelex plans offer reliable protection for travelers. The plans cover unforeseen events, allowing travelers to focus on enjoying their trips. Travelex provides peace of mind with its comprehensive coverage options.

Travelex Insurance Services is known for its competitive pricing. The cost of coverage aligns with industry standards, making it a popular choice among travelers. The affordable pricing ensures travelers receive valuable protection without exceeding their budget.

Image Source: cdc

Comparison of the Top 5 Plans

Choosing the right travel insurance plan can feel overwhelming with so many options available. Let’s break down the differences in coverage and pricing among the top five affordable travel insurance plans. This comparison will help you find the best fit for your travel needs.

Coverage Differences

Medical coverage is a crucial aspect of any travel insurance plan. Allianz Travel Insurance offers emergency medical assistance, ensuring travelers receive necessary care during their trips. Travel Guard Essential Plan provides basic medical coverage suitable for domestic and business travelers. Nationwide Travel Insurance covers emergency medical expenses, offering peace of mind for unforeseen health issues. Trawick International stands out with comprehensive medical coverage, including emergency evacuation and repatriation services. Travelex Insurance Services also provides solid medical coverage, making it a reliable choice for travelers.

Trip cancellation protection varies across these plans. Allianz Travel Insurance covers cancellations due to unforeseen medical issues, providing a safety net for travelers. Travel Guard Essential Plan offers basic trip cancellation coverage, ideal for budget-conscious travelers. Nationwide Travel Insurance includes robust trip cancellation options, ensuring travelers are protected against unexpected changes. Trawick International provides strong coverage against cancellations, including Covid-related cancellations. Travelex Insurance Services offers comprehensive trip cancellation coverage, allowing travelers to plan with confidence.

Baggage protection is another important feature to consider. Allianz Travel Insurance covers lost or delayed baggage, helping travelers recover quickly from inconveniences. Travel Guard Essential Plan includes baggage loss or delay coverage, providing essential protection. Nationwide Travel Insurance offers reliable baggage protection, ensuring travelers’ belongings are safe. Trawick International excels in this area, covering lost or delayed luggage comprehensively. Travelex Insurance Services provides baggage protection, allowing travelers to focus on their journey without worry.

Pricing Comparison

Pricing plays a significant role in choosing a travel insurance plan. Allianz Travel Insurance starts at around $27, offering affordable options for various budgets. Travel Guard Essential Plan is known for its budget-friendly pricing, making it accessible to many travelers. Nationwide Travel Insurance aligns with industry standards, providing competitive pricing. Trawick International offers budget-friendly plans, ensuring value for money without compromising on coverage. Travelex Insurance Services maintains competitive pricing, making it a popular choice among travelers.

Value for money is essential when selecting a travel insurance plan. Allianz Travel Insurance provides extensive benefits, ensuring travelers receive great value. Travel Guard Essential Plan offers necessary coverage at an affordable price, appealing to budget-conscious travelers. Nationwide Travel Insurance delivers reliable protection, making it an attractive option for many. Trawick International ensures comprehensive coverage, offering excellent value for cost-conscious travelers. Travelex Insurance Services provides valuable protection, allowing travelers to enjoy their trips without exceeding their budget.

Choosing the right travel insurance plan requires careful consideration. Travelers should assess their needs and compare plans based on coverage, benefits, and pricing. Purchasing insurance early ensures maximum protection. Early purchase often provides broader coverage, including pre-existing conditions. Travel insurance offers peace of mind and financial security. Protection against trip cancellations, medical emergencies, and baggage loss proves invaluable. The OneTrip Prime Plan offers up to $100,000 for trip cancellation and $50,000 for emergency medical coverage. Travelers can enjoy their adventures without worry. Investing in travel insurance guarantees a safer and more enjoyable journey.

Business

Boost Efficiency with Smart Inventory Management Solutions

Image Source: unsplash

Inventory management plays a crucial role in business success. Businesses can achieve higher profits and streamlined operations by addressing overstocking and understocking. Investing in the top inventory management software for businesses significantly reduces errors and inefficiencies. This investment saves time and money. Many supply chain professionals focus on optimizing inventory to balance supply and demand. The right software enhances customer service by ensuring product availability. Businesses that leverage advanced tools gain a competitive edge in today’s market.

Criteria for Selecting Inventory Management Software

Choosing the right inventory management software can transform your business operations. The right software enhances efficiency and reduces errors. Consider several key criteria when selecting the top inventory management software for businesses.

Integration Capabilities

Importance of Seamless Integration

Seamless integration with existing systems is crucial. This integration ensures smooth operations across various platforms. Inventory management software must connect with accounting and e-commerce platforms. This connection reduces manual data entry and minimizes errors. Businesses achieve better outcomes with integrated systems.

Examples of Integrations to Consider

Consider software that integrates with popular tools. Look for compatibility with accounting software like QuickBooks or Xero. Ensure integration with e-commerce platforms such as Shopify or Amazon. These integrations streamline processes and improve efficiency.

Ease of Use

User-Friendly Interfaces

User-friendly interfaces make software accessible to all team members. An intuitive design reduces training time and increases productivity. Employees quickly adapt to new systems with simple navigation. A straightforward interface enhances user experience and satisfaction.

Training and Support Resources

Comprehensive training and support resources are essential. Access to tutorials and guides helps users maximize software potential. Reliable customer support resolves issues promptly. Businesses benefit from ongoing assistance and updates.

Scalability

Adapting to Business Growth

Scalability is vital for growing businesses. Choose software that adapts to increased demand. Scalable solutions accommodate expanding inventory needs. Businesses avoid disruptions by selecting adaptable software.

Handling Increased Inventory Demands

Software must handle increased inventory demands efficiently. Robust systems manage larger volumes without compromising performance. Businesses maintain smooth operations during growth phases. Scalable software supports long-term success.

Selecting the top inventory management software for Business involves careful consideration. Evaluate integration capabilities, ease of use, and scalability. These factors ensure the software meets your business needs and supports growth.

Customer Support

Availability of Support Services

Customer support plays a pivotal role in the effectiveness of inventory management software. Businesses require access to support services at all times. Round-the-clock availability ensures that assistance is always within reach. Immediate help can prevent disruptions in business operations. Reliable support services enhance user confidence in the software.

Types of Support Offered

Different types of support cater to varied business needs. Phone support provides direct communication for urgent issues. Email support offers detailed assistance for complex queries. Live chat support delivers quick solutions during working hours. Comprehensive online resources, such as tutorials and FAQs, empower users to solve problems independently. A variety of support options ensures that businesses receive the help they need in a manner that suits them best.

Top Inventory Management Software Options

Image Source: unsplash

Selecting the right inventory management software can revolutionize your business operations. Explore some of the top options available today.

Cin7

Key Features

Cin7 offers a comprehensive suite of features designed for businesses across various industries. The software integrates seamlessly with multiple e-commerce platforms and shipping software. This integration ensures real-time synchronization of stock levels. Automated purchase orders help maintain optimal inventory levels. The built-in point-of-sale (POS) system tracks both in-store and online sales. Multi-warehouse management tools enhance operational efficiency.

Strengths and Ideal Use Cases

Cin7 excels in providing robust solutions for fast-growing businesses. The software’s seamless integration capabilities reduce the risk of overselling and stockouts. Businesses with complex supply chains benefit from its multi-location tracking. Cin7’s 24/7 customer support ensures users can resolve issues quickly. Businesses in e-commerce and manufacturing find Cin7 particularly beneficial. The software’s extensive features make it a top contender in the inventory management landscape.

Ordoro

Key Features

Ordoro stands out with its integrated shipping and inventory management solutions. The software supports multichannel selling, allowing businesses to manage inventory across various platforms. Automated dropshipping and kitting features streamline order fulfillment. Ordoro provides advanced analytics and reporting tools for data-driven decision-making. The user-friendly interface simplifies navigation and reduces training time.

Strengths and Ideal Use Cases

Ordoro is ideal for multichannel sellers seeking a unified platform. The software’s integrated shipping solutions enhance efficiency and reduce errors. Businesses benefit from its ability to handle complex order fulfillment processes. Ordoro’s analytics tools provide valuable insights into sales performance. The software’s ease of use and responsive customer support receive high praise from users. Businesses looking to optimize multichannel operations find Ordoro an excellent choice.

inFlow

Key Features

inFlow offers specialized features for business-to-business (B2B) and wholesale operations. The software provides real-time inventory tracking and order management. Barcode scanning and serial number tracking enhance accuracy and efficiency. Customizable pricing and discount options cater to diverse business needs. inFlow’s reporting tools deliver actionable insights for strategic planning.

Strengths and Ideal Use Cases

inFlow is recommended for B2B and wholesale businesses. The software’s real-time tracking capabilities ensure accurate inventory management. Businesses benefit from its customizable pricing options and detailed reporting. Users appreciate inFlow’s straightforward setup and minimal complications. The software’s value for money and responsive customer support make it a popular choice. Businesses seeking a reliable solution for B2B operations find inFlow highly effective.

Katana

Key Features

Katana provides real-time inventory tracking and production scheduling. Businesses can monitor stock levels and manage manufacturing processes efficiently. The software offers visual dashboards for easy data interpretation. Users can access information on raw materials and finished goods instantly. Katana integrates with popular e-commerce platforms to streamline operations. The software supports barcode scanning for accurate inventory management.

Strengths and Ideal Use Cases

Manufacturers find Katana particularly beneficial. The software’s real-time tracking ensures precise inventory control. Businesses can optimize production schedules with ease. Katana’s visual dashboards enhance decision-making capabilities. The integration with e-commerce platforms simplifies sales management. Manufacturers seeking efficiency and accuracy choose Katana as a top inventory management software for businesses.

Zoho Inventory

Key Features

Zoho Inventory excels at managing inventory across multiple channels. The software offers automated workflows to reduce manual tasks. Users can track shipments and manage orders effortlessly. Zoho Inventory provides detailed analytics for informed decision-making. The software integrates with various payment gateways for seamless transactions. Businesses benefit from the mobile app for inventory management on the go.

Strengths and Ideal Use Cases

Businesses looking for value appreciate Zoho Inventory. The software’s multi-channel management enhances operational efficiency. Automated workflows save time and minimize errors. Zoho Inventory’s analytics tools provide valuable insights. The mobile app offers flexibility for inventory management. Companies seeking a cost-effective solution find Zoho Inventory ideal.

Fishbowl

Key Features

Fishbowl offers a quick plug-and-play solution for warehouse management. The software provides tools for inventory tracking and order management. Users can generate purchase orders automatically based on stock levels. Fishbowl integrates with accounting software for streamlined financial management. The software supports barcode scanning for accurate inventory updates. Businesses can customize reports for specific needs.

Strengths and Ideal Use Cases

Warehouse managers prefer Fishbowl for its ease of use. The software’s plug-and-play nature ensures a straightforward setup. Businesses can manage inventory and orders efficiently. Fishbowl’s integration with accounting software simplifies financial tasks. The customizable reports offer insights into inventory performance. Companies seeking a reliable warehouse management solution choose Fishbowl.

Extensiv

Key Features

Extensiv offers robust solutions for diverse business needs. The software provides comprehensive inventory management capabilities. Businesses can track stock levels in real time. Extensiv supports integration with various e-commerce platforms. This feature enhances operational efficiency. Users can manage inventory across multiple channels effortlessly. The software includes advanced reporting tools. These tools offer valuable insights for strategic decision-making. Extensiv’s user-friendly interface simplifies navigation. Businesses benefit from a straightforward setup process.

Strengths and Ideal Use Cases

Extensiv excels in providing reliable customer support. Users praise the swift resolution of issues. A testimonial highlights, “Any issue that has arisen has been dealt with swiftly and effectively. 10/10.” Businesses appreciate the software’s value for money. Extensiv meets inventory and asset management needs with minimal complications. The software is ideal for businesses seeking an efficient inventory management solution. Companies looking to optimize operations find Extensiv highly effective.

Netsuite

Key Features

Netsuite offers comprehensive inventory management capabilities. The software supports real-time tracking of stock levels. Businesses can manage inventory across multiple locations. Netsuite integrates with various business systems seamlessly. This integration reduces manual data entry and errors. The software provides advanced analytics for informed decision-making. Users can customize reports to meet specific business needs. Netsuite’s cloud-based platform ensures accessibility from anywhere.

Strengths and Ideal Use Cases

Netsuite is suitable for larger enterprises. The software’s scalability supports business growth. Businesses benefit from their ability to handle complex inventory demands. Netsuite’s integration capabilities enhance operational efficiency. Companies with multiple locations find the software particularly beneficial. The software’s comprehensive features make it a top choice for large-scale operations. Businesses seeking a robust inventory management solution choose Netsuite.

Sortly

Key Features

Sortly provides an easy-to-use inventory tracking solution. The software allows businesses to manage inventory from any device. Users can track stock levels and manage orders effortlessly. Sortly supports barcode scanning for accurate inventory updates. The software offers customizable reports for detailed insights. Businesses can access information on inventory performance instantly. Sortly’s mobile app enhances flexibility for inventory management.

Strengths and Ideal Use Cases

Sortly is ideal for small businesses. The software’s user-friendly interface simplifies inventory management. Businesses appreciate the ease of use and quick setup process. Sortly offers value for money with its affordable pricing. Companies seeking a straightforward inventory tracking solution find Sortly effective. The software’s mobile app provides convenience for on-the-go management. Businesses looking for a cost-effective solution choose Sortly.

ShipBob Merchant Plus

Key Features

ShipBob Merchant Plus offers a unique hybrid fulfillment capability. Businesses can manage inventory with ease. The software provides tools for efficient order processing. Users benefit from real-time inventory tracking. ShipBob integrates seamlessly with popular e-commerce platforms. This integration ensures smooth operations across multiple sales channels. Businesses can enjoy automated shipping solutions. The software supports barcode scanning for accurate inventory updates. ShipBob Merchant Plus also offers customizable reporting features. These reports provide valuable insights into inventory performance.

Strengths and Ideal Use Cases

ShipBob Merchant Plus excels in providing a comprehensive solution for businesses with diverse inventory needs. The software’s hybrid fulfillment capabilities enhance operational efficiency. Businesses can reduce errors and improve customer satisfaction. Users appreciate the straightforward setup process. ShipBob Merchant Plus offers value for money. Responsive customer support ensures quick resolution of issues. A user testimonial states, “Any issue that has arisen has been dealt with swiftly and effectively. 10/10.” Businesses seeking an efficient inventory management solution find ShipBob Merchant Plus highly effective. Companies looking to optimize their fulfillment processes choose ShipBob Merchant Plus as a top inventory management software for businesses.

Choosing the right inventory management software is crucial for your business success. The right software can streamline operations and enhance efficiency. Consider your specific business needs when making a decision. Evaluate features like integration capabilities and scalability. Cin7 offers robust solutions for fast-growing businesses. Ordoro excels in multichannel sales management. inFlow provides specialized features for B2B operations. Each software has unique strengths. Select the one that aligns with your goals. Optimize your inventory processes and gain a competitive edge. Make an informed choice to drive profitability and growth.

Business

Income Protection: Benefits, Costs, and Coverage Options

Benefits of Income Protection Insurance

Income protection insurance offers peace of mind when life throws unexpected health challenges your way. Imagine being unable to work due to an illness or injury—how would you manage your bills and daily expenses? That’s where this essential coverage steps in, providing the financial support you need during tough times. Unfortunately, many people overlook this vital part of financial planning, not realizing its importance until it’s too late.

For those who have taken the step to protect their income, it’s been a game-changer, offering security and stability when they needed it most. Legal & General’s Income Protection Insurance goes above and beyond with its comprehensive coverage and additional support services. It’s more than just a policy; it’s a lifeline that ensures you can focus on your recovery without worrying about your finances.

Definition and Purpose

Explanation of income protection insurance

Income protection insurance acts as a financial safety net when you’re unable to work due to illness or injury. Instead of worrying about how to make ends meet, you can rely on this coverage to keep a steady income coming in during those tough times. Legal & General offers a policy that steps in to replace a portion of your salary, helping you stay on top of your finances and focus on what really matters—getting better.

Purpose and importance

Income protection insurance is all about securing your financial future, especially when life takes an unexpected turn. Health issues can strike out of nowhere, making it hard to keep up with your earnings. With income protection insurance, you don’t have to worry about covering your essential expenses—it’s there to help you stay afloat. This kind of coverage offers more than just money; it gives you and your loved ones peace of mind, knowing that your financial stability is protected, no matter what comes your way.

How it Differs from Other Insurances

Comparison with health insurance

Health insurance takes care of your medical bills and hospital stays, but it doesn’t help with everyday living expenses if you’re unable to work. That’s where income protection insurance comes in. While health insurance focuses on treatments, income protection is there to replace your lost income, ensuring you have the cash you need for rent, groceries, and other essentials. It fills the gap, providing the financial support you need to keep life on track during difficult times.

Life insurance

Life insurance is there for your loved ones, providing them with a lump sum after you’re gone. But what happens if you’re still here and can’t work due to illness? That’s where income protection insurance steps in. Unlike life insurance, which doesn’t help with the financial strain of being unable to earn a living, income protection ensures you can keep paying your bills and maintaining your lifestyle while you focus on getting better. It’s support for you when you need it most, ensuring your immediate financial needs are met while you’re still alive.

Income Protection: Benefits, Costs, and Coverage Options

Image Source: pexels

Benefits of Income Protection Insurance

Financial Security

Income protection insurance is like having a dependable financial safety net when life throws you a curveball. If illness or injury keeps you from working, this insurance steps in to provide a steady income, allowing you to maintain your lifestyle without the added worry of money troubles. Your essential expenses—like mortgage payments and utility bills—are still covered, giving you one less thing to stress about. With this kind of security, you can focus on getting through tough times, knowing your finances are taken care of.

Flexibility and Customization

Income protection insurance gives you the flexibility to create coverage that fits your unique needs. You can adjust the policy to match your specific situation, whether that means setting the right benefit amount or choosing how long the coverage lasts. This personalized approach ensures you get the support that’s just right for you. Legal & General offers a range of customizable options, making it easy to find a plan that suits your lifestyle and financial goals.

Costs of Income Protection Insurance

Factors Affecting Cost

The cost of income protection insurance depends on several key factors that help shape your premiums. Your age and the type of work you do are big considerations—certain jobs might come with higher risks, which can affect the price. Your health and lifestyle choices also play a role; things like smoking or pre-existing conditions can impact the cost. Additionally, the amount of coverage you choose and how long you’re willing to wait before the benefits kick in will influence the price. Knowing how these factors work together can help you make informed choices that fit your budget and needs.

Ways to Reduce Premiums

There are a few ways to make your income protection insurance more affordable. One option is to choose a longer waiting period before your benefits start, which can lower your premiums. You might also consider selecting a smaller benefit amount to keep costs down. Staying healthy can pay off too—many insurers offer discounts for those with a healthy lifestyle. It’s also a good idea to regularly review your coverage to ensure it still fits your needs, making adjustments as your life changes. These steps can help you get the protection you need at a price that works for you.

Coverage Options

Short-term vs Long-term

Income protection insurance comes in two main flavors: short-term and long-term coverage. Short-term options provide financial support for a set period, perfect if you need help for a few months. Long-term coverage, on the other hand, can extend until you retire or return to work, giving you peace of mind for a longer stretch. You can choose the type that best fits your situation and needs. Each option has its own benefits, so you can pick what works best for your personal circumstances.

Individual vs Group Policies

When it comes to income protection, you have the choice between individual and group policies. Individual policies are customized to fit your specific needs, offering coverage that’s tailored just for you. On the other hand, group policies are often available through your employer or an association, providing coverage as part of a broader plan.

Each type has its own set of benefits and things to consider. Individual policies might offer more flexibility and customization, while group policies can be more cost-effective and convenient. It’s worth evaluating both options to see which one aligns best with your personal situation and needs.

Practical Considerations

Eligibility and Application Process

Income protection insurance is a lifesaver for anyone who depends on a regular paycheck. When unexpected health issues pop up, it can throw your financial stability off balance. This is especially true for self-employed people who don’t have employer benefits to fall back on. Parents and caregivers also need that extra layer of financial security to support their dependents. Even young professionals can benefit from getting coverage early, ensuring their future earnings are protected. It’s all about keeping your finances steady, no matter what life throws your way.

How to apply

Applying for income protection insurance involves several steps. Start by researching different insurance providers. Compare policies to find the best fit for personal needs. Gather necessary documents like proof of income and medical history. Contact an insurance agent or use online platforms for application. Complete the application form with accurate information. Await approval and review policy details upon acceptance.

Frequently Asked Questions

What happens if I change jobs?

Changing jobs often raises questions about income protection insurance. The flexibility of most policies allows you to carry coverage to a new job. You can maintain financial security during career transitions. Contact the insurance provider to update employment details. Ensure that the policy remains active and continues to provide protection. Legal & General’s Income Protection Insurance supports job changes without losing benefits.

Can I have multiple policies?

Multiple income protection insurance policies can enhance financial security. Each policy can cover different aspects of income loss. Evaluate personal needs and financial goals before acquiring additional coverage. Ensure that combined benefits do not exceed income limits set by providers. Legal & General offers customizable options to complement existing policies. Consider diverse coverage to maximize protection and peace of mind.

Anonymous shared a powerful testimonial: “Recently I had an accident that would have caused big problems financially if I had not had income protection. This is where Income Protection Insurance was a life saver, as they paid me 90% of the income I had made in the last twelve months including all overtime, and not the base annual salary I would have got without overtime. It was almost like I hadn’t actually stopped work. I was able to relax and get over my injury, as well as enjoy my newborn son without the issue of unpaid bills standing over my head.”

Income protection insurance ensures that unexpected events do not disrupt your life. Embrace the security and freedom that come with comprehensive coverage.

Income protection insurance plays a crucial role in securing financial stability. This insurance ensures that you can maintain your lifestyle when illness or injury strikes. Consider your personal needs and explore various options. Evaluate how income protection can safeguard your future. Take proactive steps to protect your income today. Research different policies and consult with experts. Legal & General offers comprehensive coverage tailored to individual needs. Embrace the peace of mind that comes with knowing your financial future is secure.

-

News2 years ago

News2 years agoKolkata Doctor Case: Tragic Story of Dr. Moumita Debnath

-

Health And Fitness2 years ago

Health And Fitness2 years agoPepsi Zero Sugar vs Diet Pepsi: Which Is Healthier?

-

Health And Fitness1 year ago

Health And Fitness1 year agoWhere to Find Oreo Flavored Coke Zero Near You

-

Health And Fitness1 year ago

Health And Fitness1 year agoHow to Choose a Rehab for Lasting Recovery

-

Tech Innovation2 years ago

Tech Innovation2 years agoTop Machine Learning and Deep Learning Trends for 2024

-

News2 years ago

News2 years agoLondon King Opens Up About Her Relationship with Rob Schneider

-

News1 year ago

News1 year agoTyra Banks Biography: Age, Husband, Net Worth

-

Tech Innovation1 year ago

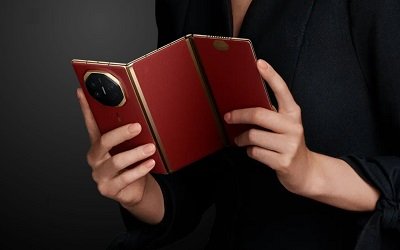

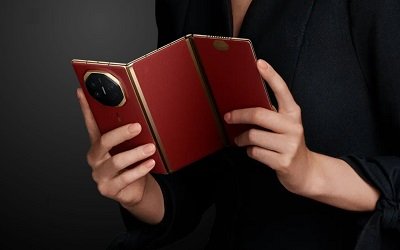

Tech Innovation1 year agoHuawei Mate XT: A Detailed Review of the World’s First Tri-Fold Smartphone